What’s Next for UK Holidays? Key Travel Trends and Insights for 2025

ABTA, the UK’s largest association for travel agents and tour operators, has supported the tourism industry with insights and expertise for over seven decades. Since 2010, ABTA has conducted annual research to forecast holiday trends for the following year. Their latest report, based on a survey of 2,000 UK adults conducted from 24 July to 2 August 2024, explores holiday habits over the past year as well as upcoming travel intentions.

The 2024-2025 findings reveal that 84% of UK travelers took more trips this year compared to previous years, indicating that travel confidence is on the rise. There has also been a significant increase in people booking international holidays through travel agents (38%), largely to have reliable support in case of issues. Additionally, customers are still looking to the travel industry to help them make sustainable choices, with many expecting more eco-conscious options. Finally, this year’s report explored what travel means to people personally, uncovering the top reasons that inspire them to take holidays.

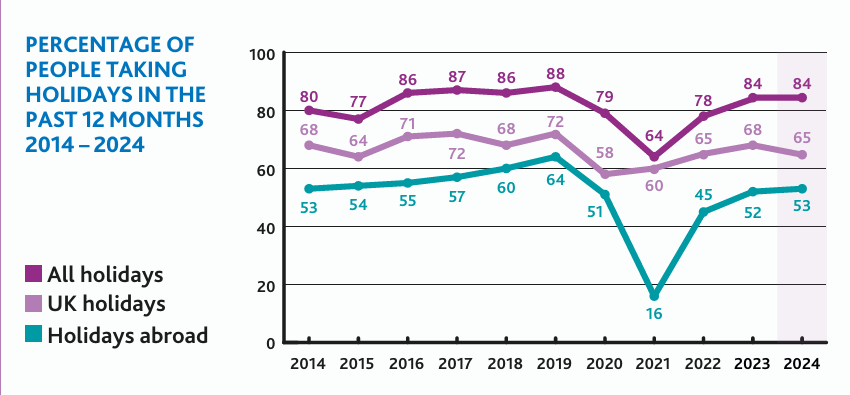

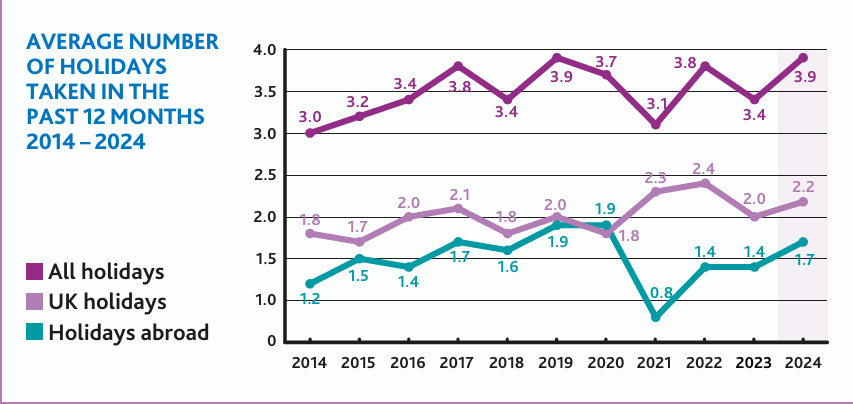

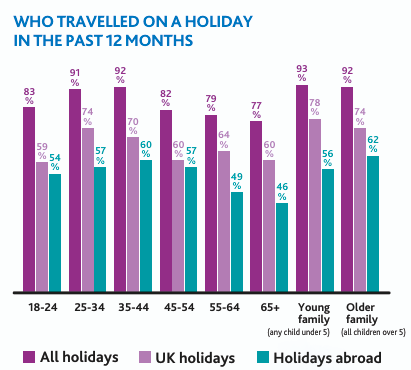

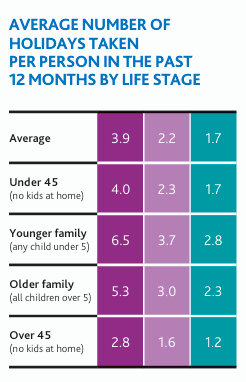

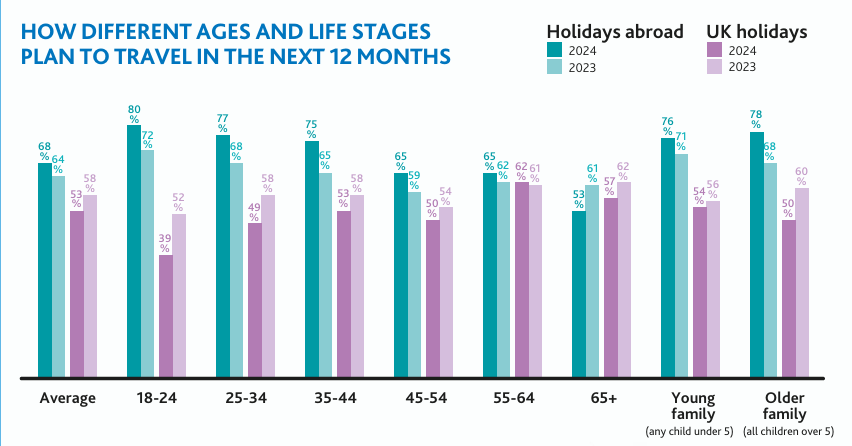

While the total number of holidays has seen a notable increase this year, the proportion of people taking holidays has remained stable. The average number of holidays per person has grown from 3.4 to 3.9, reaching the highest level since 2019. Travelers took 1.7 holidays abroad (up from 1.4) and 2.2 domestic breaks (up from 2.0). However, the percentage of people traveling remains the same at 84%, with a slight year-on-year increase in international travel (53%, up from 52%) and a small decrease in those taking UK holidays (65%, down from 68%). This suggests that the demand for holidays is robust, primarily driven by regular travelers who are taking more trips.

According to the findings of the research families are still the most frequent travelers, with those with older children traveling abroad at higher rates than those with younger children in the past year (62% vs 56%). Families with young children led the way, taking an average of 6.5 holidays, a jump from 5.3 holidays the year before. Families with older children also increased their holiday frequency, going on 5.3 trips compared to 4.0 last year.

Looking at age groups, there were some key changes. The 45-54 age group saw a notable increase in overseas travel, rising from 47% to 57%, while 35-44-year-olds also increased their international trips, from 55% to 60%. In contrast, the over-65s and 18-24-year-olds both experienced declines in overseas travel, with the former dropping from 49% to 46% and the latter from 60% to 54%. These shifts reflect a period of great change, from the pandemic recovery to the cost-of-living crisis, with different age groups adjusting in varying ways. It seems those aged 35-54 are now catching up on travel after a cautious start, while younger and older travelers had different patterns of response.

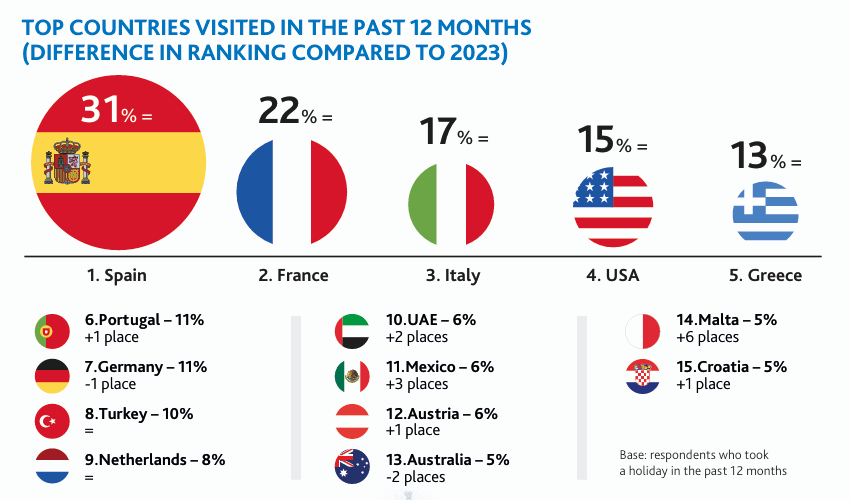

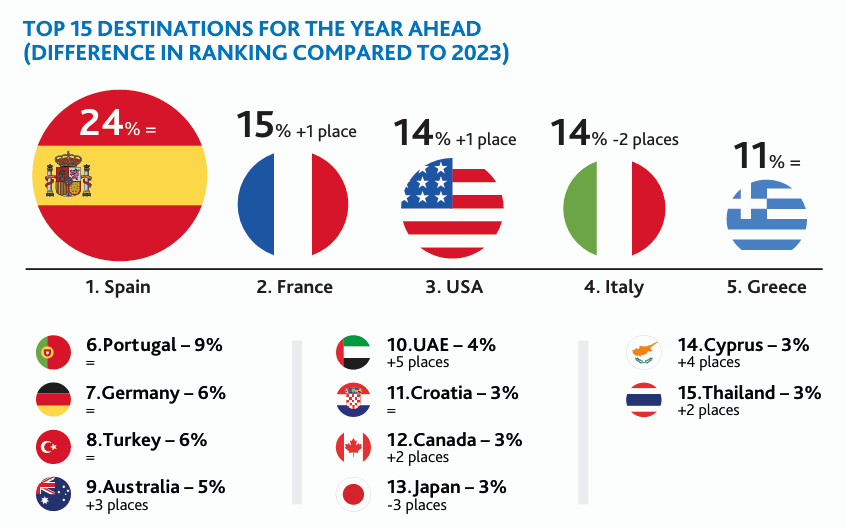

Europe dominated as the top destination for UK travelers, with 83% taking a European holiday in the past year. Spain remained the preferred spot, while the top nine destinations were largely unchanged, apart from a switch between Germany and Portugal. The UAE moved up two spots to become the 10th most-visited country, drawing particular interest from 18-24-year-olds (12% of whom visited). Additionally, Mexico, Austria, Malta, and Croatia rose in popularity. Although "coolcations" (vacations to cooler climates) have emerged as a concept, UK travelers still heavily favor sunny locations, suggesting that trips to cooler places are the exception rather than the norm.

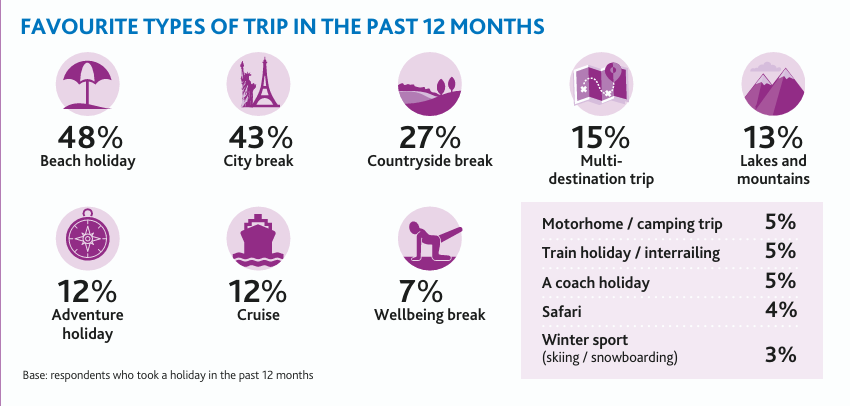

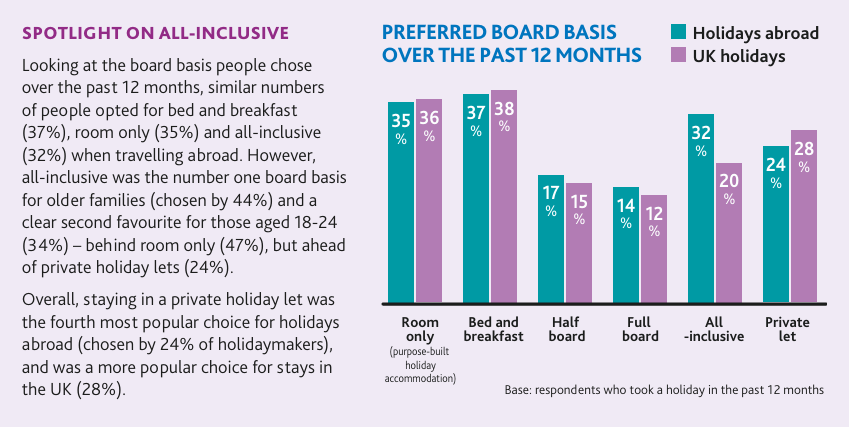

This year’s research takes a refined approach by categorizing holidays not only by trip type but also by accommodation type, such as all-inclusive resorts and private home rentals. Among the findings, beach holidays and city breaks led in popularity, with 48% visiting the beach over the last year—this figure rises to 56% among families. Countryside escapes were chosen by 27% of travelers, especially those over 55, with 32% of this age group favoring rural retreats. Adventure holidays attracted 12% overall but were far more popular with younger adults: 29% of 18-24-year-olds and 25% of 25-34-year-olds, a level of interest similar to cruises. Furthermore, younger age groups were about twice as likely as average travelers to go on safaris and winter sports holidays, with safari trips at 8% for both age groups, and winter sports attracting 8% of 25-34s and 7% of 18-24s

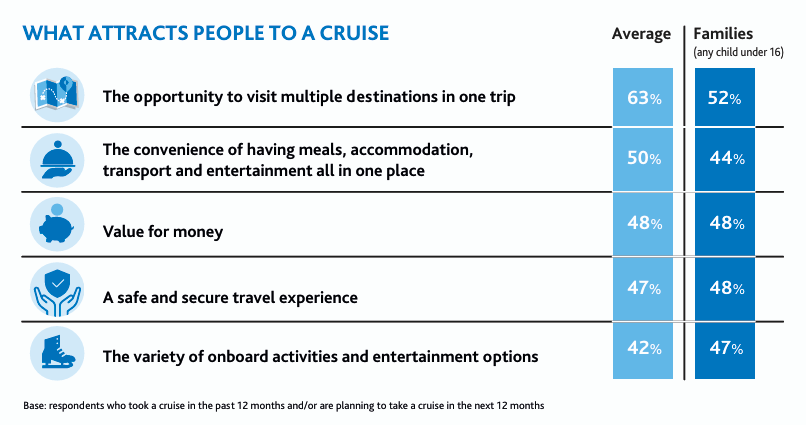

According to research cruising is increasingly popular with families, with nearly double the number of parents taking cruises this year compared to 2019—up from 8% to 15%. Plans for the year ahead also show rising interest, with 17% of families aiming to cruise, slightly above the 14% average. When it comes to cruise types, 51% of parents favor UK cruises, followed by wellness (44%) and ocean cruises (42%). Families also have a higher interest in shorter cruise options, with 24% of parents considering weekend cruises versus the 13% average. Additionally, 49% of families appreciate the opportunity to meet other like-minded travelers, compared to a 31% average, and 56% of families with young children value affordability in cruise choices, higher than the 48% average.

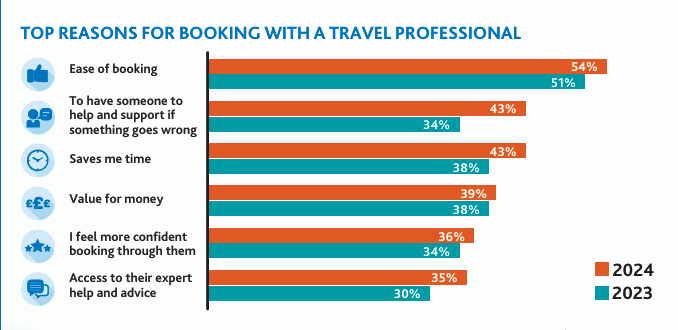

Let's take a closer look at the travel habits of the British. This year, 38% of people booked their holidays through travel professionals, an increase from 34% last year. While convenience remains the leading reason, the reassurance of having help during disruptions saw a sharp rise in importance, with 43% of respondents citing it (up from 34%). Challenges such as wildfires and air traffic control issues have highlighted the benefits of expert assistance. The trend is particularly strong among young families and younger travelers: bookings with professionals by families with young children rose from 36% in 2019 to 55% this year, and among 18–24-year-olds, the figure jumped from 36% to 48% over the same period.

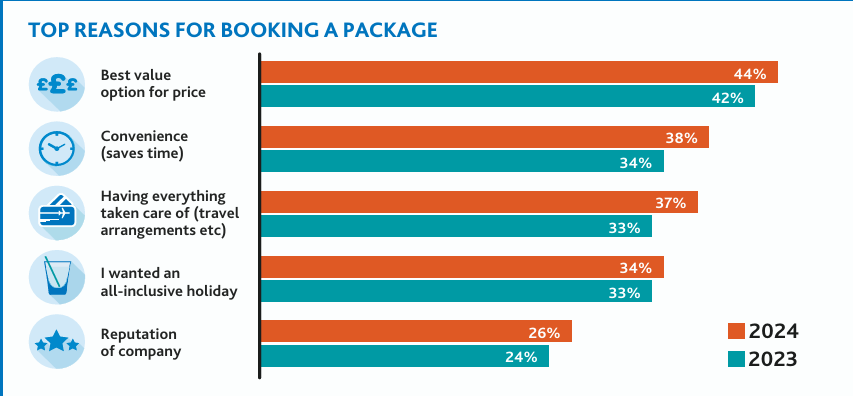

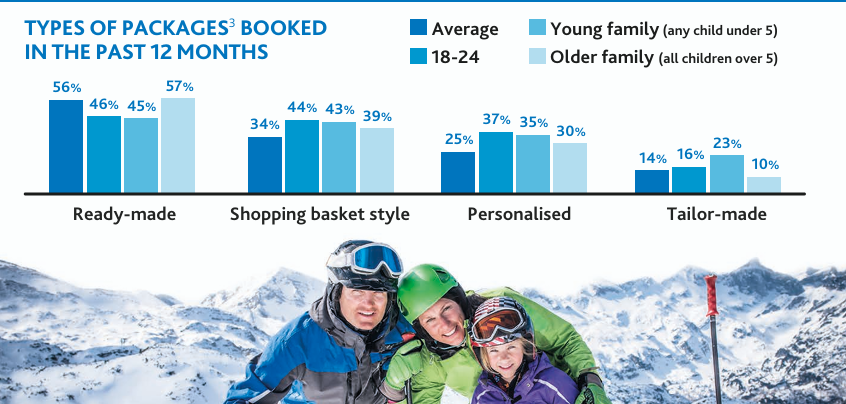

Quick, affordable, and convenient, package holidays continue to lead in popularity, with 62% of people who traveled abroad in the last year choosing this option (up from 61%). This preference is particularly high among families, with 77% selecting packages (up from 74%), and younger travelers aged 18–24, with 71% booking packages, an increase from 65%. Reasons for booking packages include value for money, noted by 44% of travelers (up from 42%), time saved (38%, up from 34%), and the ease of having everything arranged (37%, up from 33%). The most popular choice remains ready-made packages, which saw an increase from 51% to 56%, and in the family market, younger families are twice as likely to prefer customized packages compared to families with older children.

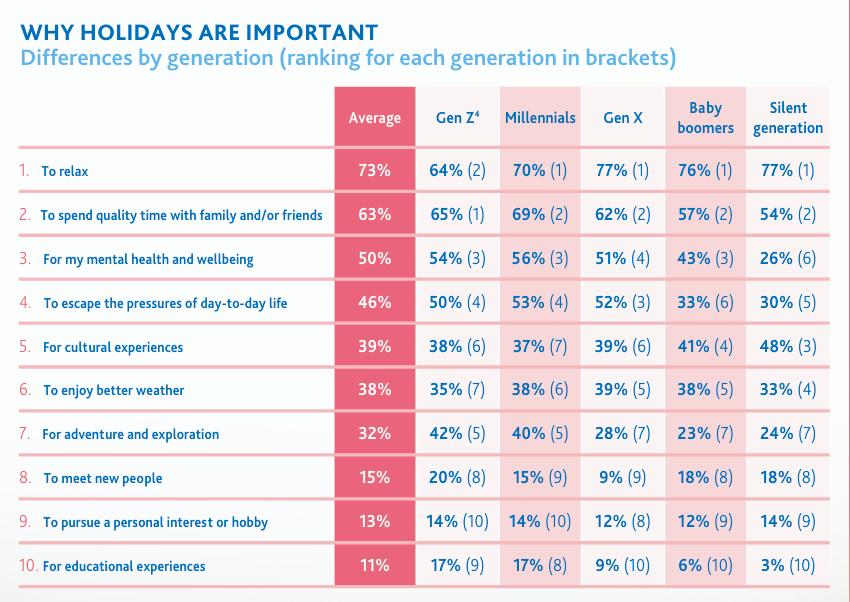

Why are holidays so important after all? This year’s findings shed light on why people across generations go on holiday. For Gen X, Baby Boomers, and the Silent Generation, relaxation is the top priority, with time spent with family and friends a close second. Gen Z and Millennials, however, place equal value on both. Mental health benefits are also a big factor for younger generations, with over 50% of Gen Z, Millennials, and Gen X citing this, compared to 44% of Baby Boomers and 26% of the Silent Generation. Additionally, meeting new people appeals to one in five Gen Z, Baby Boomers, and Silent Generation respondents, while about one in eight across generations consider holidays as an opportunity for personal hobbies or interests.

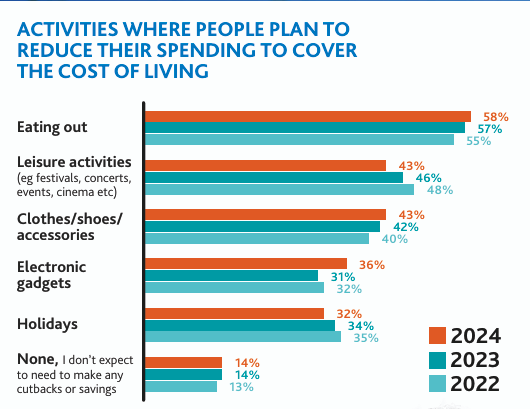

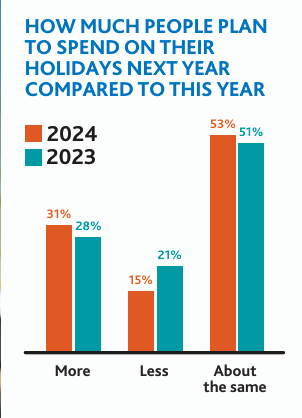

Even though the rising cost of living has reshaped how people plan their holidays, vacations still remain a priority with only 32% declaring that they would cut back on holidays to save money, if they needed to save, compared to 58% who would reduce spending on eating out. For next year, 31% of people plan to increase their holiday spending (up from 28%), while 53% will spend the same. However, 15% of travelers intend to reduce their holiday budgets, with 44% citing rising daily expenses such as food and energy, and 22% blaming higher rent or mortgage payments. Among those increasing their holiday spending, 46% want to take more holidays, while 36% expect costs to rise. Booking behavior is also influenced by financial pressures. For those booking later than usual, 25% said the cost of living was a factor, making it the second-most common reason behind waiting for better prices (32%). Meanwhile, 22% of early bookers mentioned cost of living, ranking it sixth after better deals (44%), availability (40%), a wider choice (34%), securing their desired destination (30%), and arranging time off work (23%).

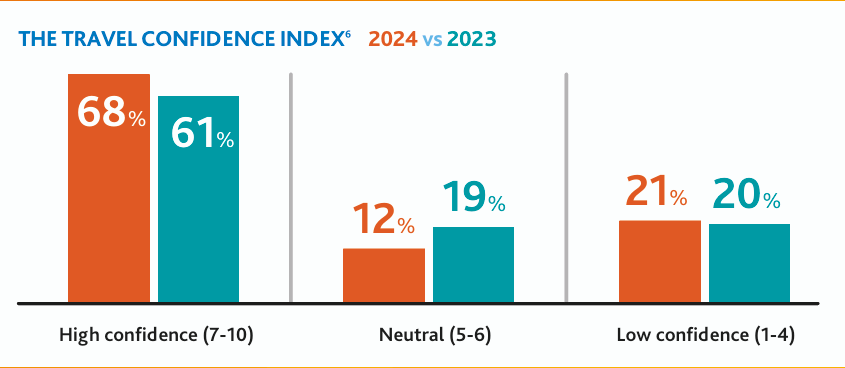

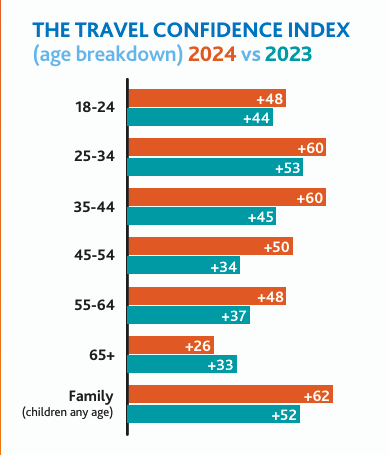

Launched last year, ABTA’s Travel Confidence Index is a vital tool for tracking how secure UK consumers feel about overseas travel. It provides an annual gauge of national confidence, breaks down trends across age groups and traveler demographics, and points out actionable steps for the industry to bolster trust. The index is based on responses from 2,000 adults who rate their travel confidence on a scale of 1 to 10, with 1 meaning "not confident at all" and 10 meaning "extremely confident." Neutral responses (scores of 5 and 6) are excluded, and the final score is calculated by subtracting the percentage of low-confidence ratings (1–4) from the percentage of high-confidence ratings (7–10). This approach offers a clear percentage-based indicator of public sentiment towards international travel.

With 68% of respondents in the high-confidence group and 21% in the low-confidence group, the Travel Confidence Index has risen to +47, up 6 points from last year. The increase comes mainly from previously ‘neutral’ travelers gaining more confidence, rather than a decline in low-confidence levels. Furthermore, the proportion of people rating themselves as ‘extremely confident’ to travel has grown from 17% to 21%, reflecting an overall boost in enthusiasm for travel across the UK population.

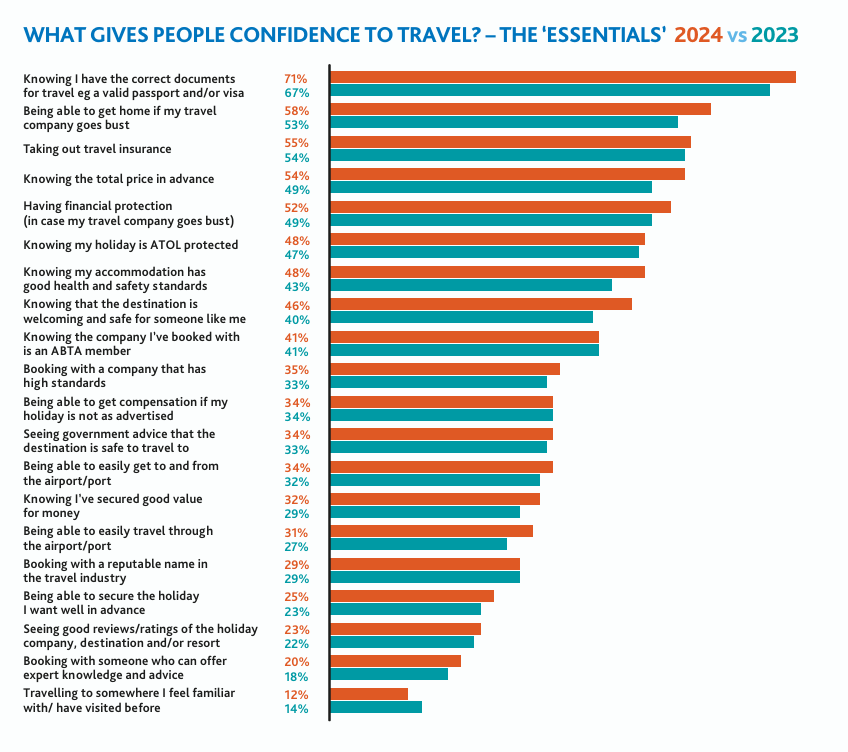

As they did last year, they provided respondents with a list of potential ‘confidence builders’ and asked them to rank them as ‘essential’, ‘important’, ‘nice to have’ and ‘not important’. While there were no dramatic year-on-year changes, there are clearly some fundamental areas that travel companies should focus on to provide the greatest levels of confidence for their customers. Getting the correct documents for travel was rated as the most essential, so it should pay dividends to advise customers if their passports will be valid for travel and help them understand the new requirements around ETIAS in 20257. Taking out travel insurance and having financial protection in case their travel company goes bust were seen as essential by more than half of respondents. Areas seeing the biggest year-on-year increase were having a welcoming and safe environment on holiday, good health and safety standards at their accommodation, and being able to get home if their travel company goes bust. Reassurance in customer conversations or marketing around these points should help customers feel more confident to travel. Knowing the total price in advance was also seen as more important than last year, illustrating that many continue to face financial pressures.’

Equally important is the fact that confidence in travel varies significantly, especially among different age groups. Those who booked with a travel professional remained the most confident (+72), while those opting for package holidays saw an increase in confidence, from +70 to +74. Families (+62) and 25-34-year-olds (+60) remain the most confident groups. Among the 45-54 age group, confidence surged the most, rising from +34 to +50, with this group also increasing international travel from 47% to 57%. In contrast, the 65+ age group saw a decrease in confidence, from +33 to +26, likely due to a drop in international travel from 49% to 46%. Older travelers also show more caution, with 73% prioritizing travel insurance (vs. 55%), 65% looking for financial protection (vs. 52%), and 59% booking with ABTA members (vs. 41%).

What eventually are the traveler’s plans for the coming year?

Looking ahead, 68% of people plan to travel abroad in the next 12 months, a slight increase from 64% last year. Meanwhile, 53% are planning a domestic break, down from 58%. Though not all of these intentions will turn into bookings, 44% of those planning international trips have already booked or started booking, while 39% of those planning UK holidays have done the same. Across all age groups, more people are planning overseas travel than last year, except for those aged 65+. Families and 18-34-year-olds are the most likely to be heading abroad. The 18-24 age group is particularly keen, with twice as many planning to travel overseas than stay in the UK. Although 65+ age group is the least likely to travel abroad, they are the most prepared, with 51% of those planning international trips already having something booked.

As for where they are planning to go?

Spain remains the top destination on the UK's travel wish list for next year, with France and the US moving ahead of Italy into second and third places, respectively. Long-haul travel is also gaining momentum, with Australia climbing three spots to ninth place, indicating a growing interest in distant destinations. There is also a noticeable rise in travelers planning to visit Asia (11%, up from 9%), Africa (7%, up from 5%), Australasia (6%, up from 4%), and South America (5%, up from 3%). Additionally, 45% of travelers plan to visit a country they’ve never been to before, a slight increase from 41% last year. This figure is even higher among 25-34-year-olds, with 65% open to exploring new destinations, reflecting a shift towards more adventurous travel choices.

Which season do citizens consider ideal to travel?

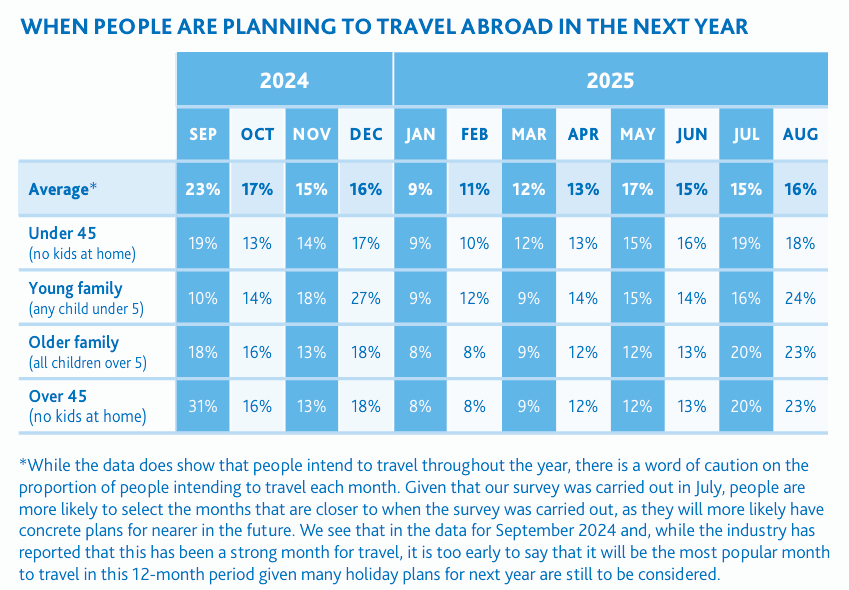

In recent years, the travel industry has witnessed a shift toward year-round holidays, moving away from the traditional peak summer travel period. This change is driven by increased consumer demand and travel companies offering more flexible travel options throughout the year. According to Holiday Habits research from this year and last, this trend is clear. As expected, those not tied to school holidays are more likely to travel year-round. Specifically, 45% of under-45s without children at home and young families with pre-school-aged children are planning holidays across various seasons. December is the most popular month for young families, with 27% planning a trip, likely for holiday celebrations. In contrast, older families are most likely to travel in the summer, with 23% planning holidays in August and 20% in July. For those without children at home, September is a favored month, likely to enjoy quieter late summer getaways.

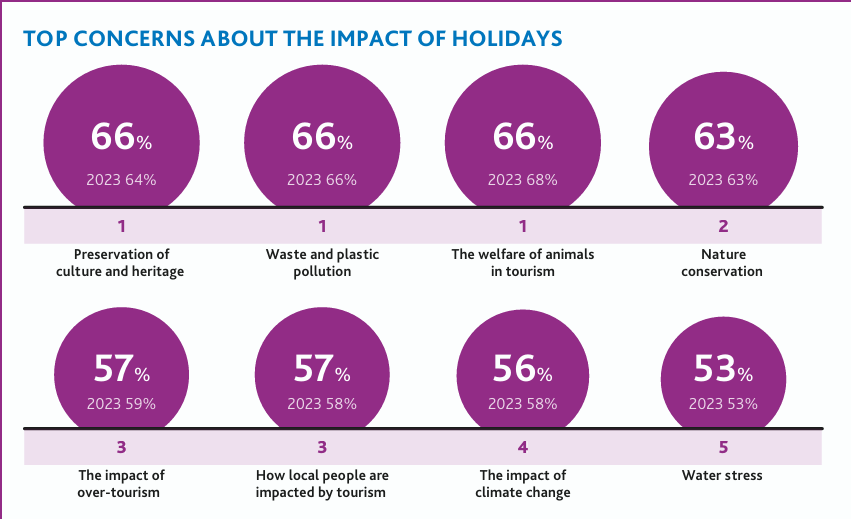

Also worth mentioning is the fact that sustainability remains a central theme for both travel businesses and consumers, as companies understand the need to address the challenges tourism brings, including its environmental impact. While many consumers expect companies to take responsibility for managing the effects of their holidays, a large portion also wants to take personal action. The top concerns for consumers continue to be animal welfare, the preservation of culture and heritage, and waste and plastic pollution. The data indicates that the public is primarily concerned about what’s happening at their travel destinations, with nature and environmental issues being central. This year, some popular destinations introduced extra measures like day charges and sustainability taxes, as well as protests from local residents about tourism’s effects. However, despite the increased focus on overtourism, our data shows minimal change in consumer concern. The only area to see an uptick is cultural preservation, which increased by 2%, while concerns about the impact on local people and overtourism slightly declined.

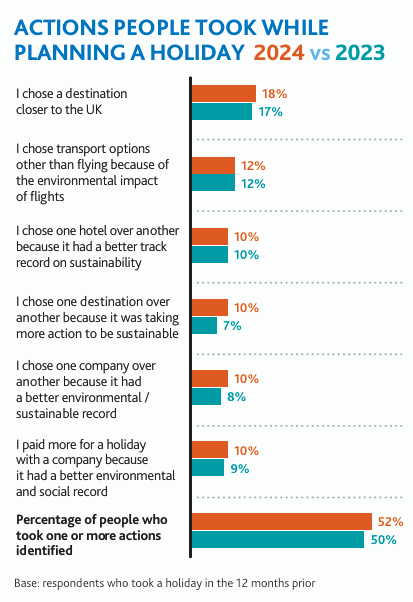

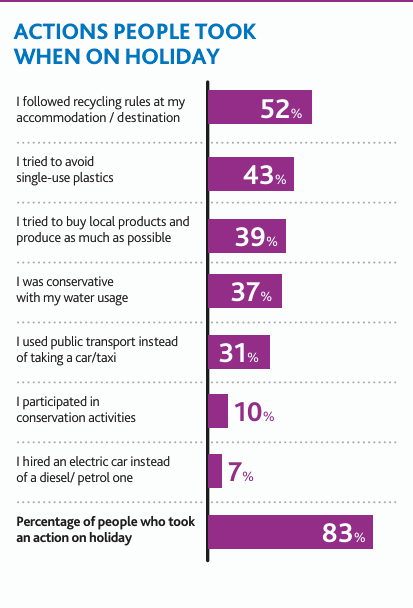

Consumers are now more focused on making responsible travel choices, with 52% of people in 2024 saying they considered environmental factors when planning their holidays, slightly up from 50% the previous year. While there is still a gap between what people intend to do and what they actually do, there has been a small increase in sustainable actions. Since this is only the second year collecting such data, it remains uncertain whether this increase signals the start of a long-term trend. For the first time, the survey also asked about actions taken while on holiday, revealing that 83% of travelers did something to make their trip more sustainable. The most common sustainability measure was recycling, with 52% of people following the recycling guidelines at their accommodations or destinations.